Lition innovates on the traditional fiat-based financial system by utilizing a unique private blockchain solution for central banks to issue and monitor digital currency usage and transactions.

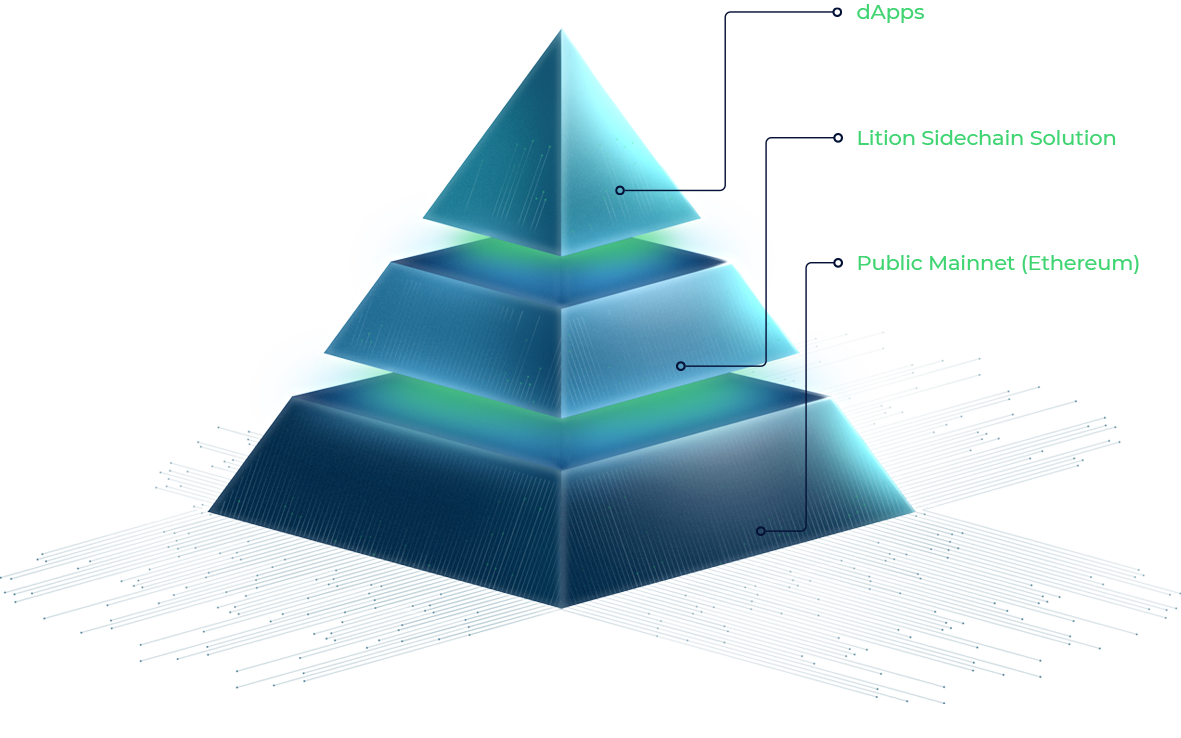

Lition is a layer 2 blockchain infrastructure built on top of Ethereum that enables commercial usage of Dapps. The Lition protocol complements the Ethereum mainchain by adding features such as privacy, scalability and deletability to meet GDPR compliance standards adopted by the EU.